Check-out the original post here, or keep reading below.

From “a PR Agency into a $3B Healthcare Data Powerhouse“ is a pretty genius set of moves. | Gif: suitsusanetwork on Giphy

Doing something a little different today - don’t be scared away by the private equity (PE) topic, as this one it still super relevant to biopharma.

Private equity is making moves in biopharma - consider Royalty Pharma’s entire business model (fyi a deep dive on royalty financing in biotech is on the docket - stay tuned) as well as the alleged “PE-ization of Pharma”.

So it might be worth knowing what PE is doing and how they do it.

Enter Edwin Yun who, after spending nearly a decade in private equity, launched a newsletter all about it called Road to Carry.

He recently wrote about the set of moves that created Real Chemistry, a massive player in the marketing analytics and media space in pharma - they help pharma interact and market to clinical trial participants, patients, and healthcare practitioners.

Edwin wrote about how Real Chemistry was formed, all from a “run-of-the-mill healthcare marketing agency into a data juggernaut powering the entire pharmaceutical value chain“ from moves orchestrated by private equity firm New Mountain.

Every else below is written by Edwin and reproduced here with his permission - if you like his writing and are interested in PE in general, subscribe to his newsletter Road to Carry - tell him I sent you!

PE Playbook: Real Chemistry

State of Play

In your investing career, you sometimes pass on a deal only to watch another firm turn it into a success. Real Chemistry (formerly W2O) is one of those for me.

Back in 2019, I saw a healthcare marketing agency doing some PR here, some digital there. Nothing special. But New Mountain saw something entirely different. Six years later, they reportedly realized a 4x return after completing a $3B single-asset continuation fund for Real Chemistry in 2025.

Let’s walk through how New Mountain transformed a seemingly run-of-the-mill healthcare marketing agency into a data juggernaut powering the entire pharmaceutical value chain—from clinical trials to new drug launches.

Company Overview

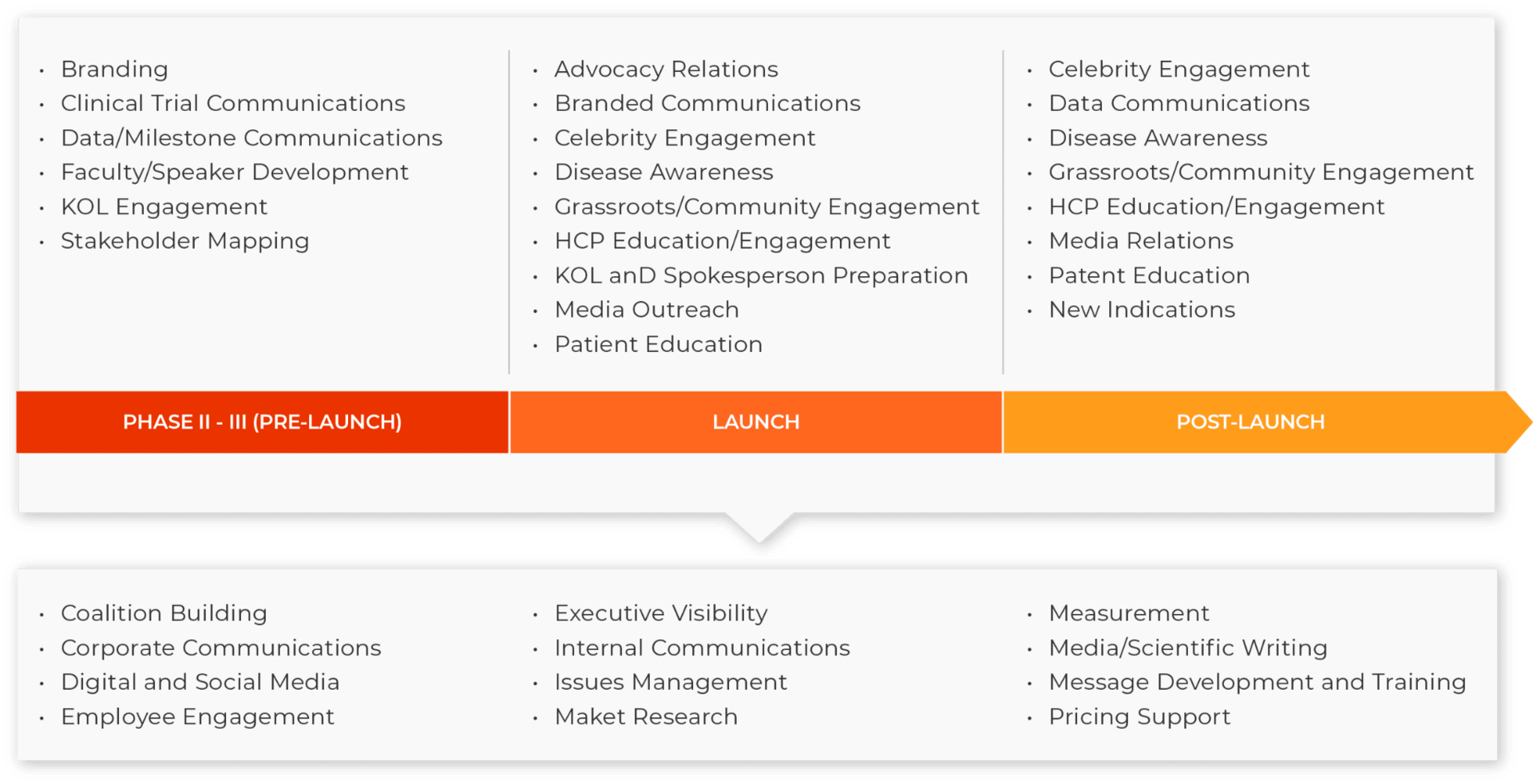

Before diving into company history, here’s a quick primer on how a marketing agency supports pharma companies across the lifecycle: clinical trials → commercialization / launch → post-launch.

Source: Syneos Health

Founding & Early Service Offerings

Real Chemistry began in 2001, when Jim Weiss launched WeissComm Partners, a boutique PR shop helping pharma companies navigate the minefield of drug launches. Every word was scrutinized, every claim triple-checked to avoid FDA scrutiny. WeissComm specialized in maintaining scientific accuracy and regulatory compliance while crafting messages simple enough for the broader public.

Mountaingate Capital Investment

By 2016, Denver-based Mountaingate Capital saw an opportunity to roll up adjacent agencies:

In 2016 alone, Real Chemistry acquired three companies:

Pure Communications. A PR agency focused on investor relations

Marketeching Solutions. Agency with social research capabilities

Sentient Interactive. A digital ad buying agency

Then, in 2019 (just before New Mountain’s deal), they added:

Arcus Medica. A medical & scientific communications agency (medical experts translating complex medical data into clear marketing messages for the general public)

ISO.heath. A medical communications & education agency (mapping key experts and creating patient and doctor education content)

Radius Digital Science. Creative services for digital ad campaigns

Revenue doubled from ~$100M to ~$200M under Mountaingate. It was a classic PE playbook: buy related services, cross-sell, integrate back-office. When New Mountain acquired the company in 2019, I thought: "Good for Mountaingate getting a nice return on a services roll-up. But why would New Mountain want this?"

New Mountain Capital Investment in 2019

New Mountain’s thesis was straightforward: healthcare marketing was fragmented, analog, and ripe for digital transformation. Real Chemistry already had the scaffolding through PR, creative, digital, and scientific communications capabilities.

Here’s how they turned that into a 4x MOIC.

New Mountain Investment Thesis / Value Creation

1. Massive TAM in Healthcare Advertising

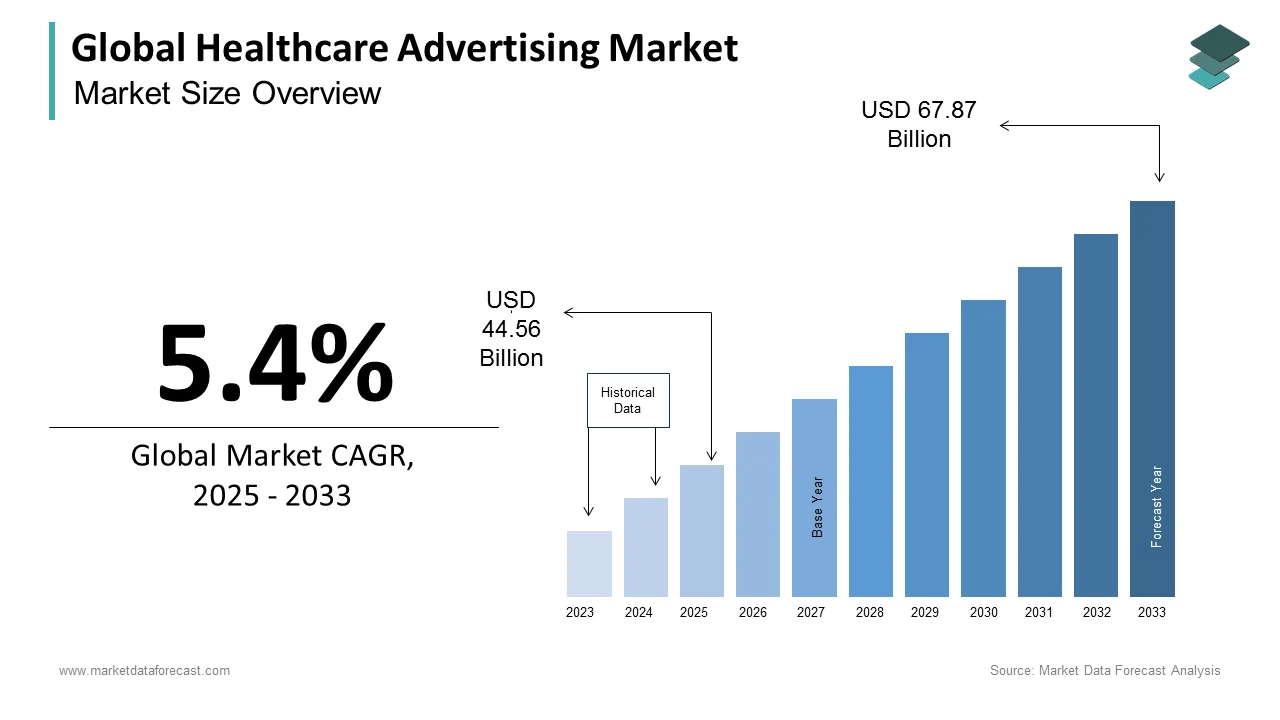

Globally, healthcare advertising is a $40B industry; in the U.S. alone, pharma companies spend ~$17B annually—making it the second-largest ad vertical after retail.

Source: Market Data Forecast

But the big opportunity for Real Chemistry was pharma’s slow digital adoption.

2. Pharma’s Digital Problem

While most industries went all-in on digital, pharma lagged. Even in 2024, pharma had the lowest share of digital ad spend among major industries.

Source: eMarketer

Note: “Digital” includes non-targeted ads

Why? HIPAA. Pharma companies can’t buy a list of diabetes patients and target them with Ozempic ads—that’s a federal crime. So, they relied on broad TV campaigns (“ask your doctor about…”) that wasted hundreds of millions to reach just a small subset of patients. Imagine spending $100M on Super Bowl ads to reach the 1,000 people with a rare disease.

Real Chemistry’s value creation lied in overcoming this structural barrier created by HIPAA with proprietary, compliant solutions.

3. Building Digital Capabilities, One Acquisition at a Time

New Mountain didn't just spray and pray with acquisitions. They had a clear thesis: transform Real Chemistry from a services company into a data-driven platform. Here's how they did it:

Wave 1: The Foundation (2019-2020)

First, they filled out the services stack:

21GRAMS: Creative storytelling (because "take this pill" doesn't cut it anymore)

Symplur: Healthcare social media analytics (mapping the online patient journey)

starpower: Influencer marketing (yes, pharma uses influencers and celebrities now)

Discern Health: Value-based care consulting (helping prove drugs actually work)

Elysia Group: Health economics (making the ROI case to insurance companies for reimbursement)

At this point, Real Chemistry could handle everything from creative campaigns to reimbursement negotiations with payers. But they were still fundamentally a services business.

Wave 2: The Game-Changers (2021)

This is where it gets interesting. Two acquisitions changed everything:

Swoop - This was the crown jewel:

Ingests 300M+ anonymized patient journeys (claims data, prescriptions, lab results)

Uses AI to identify patient cohorts (e.g., "likely undiagnosed Crohn's patients")

Creates HIPAA-compliant audience segments (by anonymizing)

Pushes these into digital ad platforms (Facebook, Google, Connected TV)

Suddenly, pharma could do precision targeting. Instead of showing Humira ads to everyone watching CNN, they could target people whose data patterns suggested inflammatory bowel disease.

IPM.ai - The rare disease specialist:

Maps "diagnostic odysseys" (the average rare disease patient sees 7 doctors over 5 years before diagnosis)

Identifies undiagnosed patients using AI pattern recognition

Helps pharma companies find the 500 patients with ultra-rare conditions

Wave 3: The Round-Up (2022-2023)

With data capabilities in place, New Mountain doubled down:

conversationHEALTH: AI chatbots for healthcare to address ~1 million licensed physicians across dozens of specialties – from primary care generalists to ultra-rare disease experts:

Virtual AI sales reps that actually understand medical questions

Personalized responses based on the doctor's specialty and prescribing patterns

Addressing the issue that 55% of doctors say they are drowning in irrelevant pharma spam ads

TI Health: Predictive analytics helping:

Forecasting which doctors will adopt new treatments

Optimizing marketing spend allocation based on those forecasts

Real-time ad campaign performance tracking

By 2023, Real Chemistry wasn't an agency anymore. It was a full-stack platform powering the entire pharma marketing lifecycle.

Looking Ahead

New Mountain capitalized on the steady shift in healthcare ad spend from traditional to digital. Real Chemistry served as a platform to quickly transform a PR agency into a data-driven health-tech platform powering clinical trial recruitment, omnichannel drug launch campaigns, and patient engagement.

The result:

Revenue grew from ~$200M in 2019 to ~$600M by 2023

A 4x return via a $3B continuation fund in 2025

For me, the sting isn’t missing a hot market—healthcare ad spend was growing at a steady 5–7% annually. The alpha came from taking share from legacy channels and expanding the pie with better targeting.

Here's my takeaway: the best opportunities often hide in plain sight, especially in regulated industries others avoid. I'm wondering what other opportunities I'm overlooking right now as I write this piece.

Thanks again Edwin for letting us share this! If you’re interested in how private equity works (not just in healthcare/pharma), subscribe to his newsletter Road to Carry.

Thanks for reading! -Anis

Disclaimer: Content, news, research, tools, and mention of stock or tradeable securities are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here